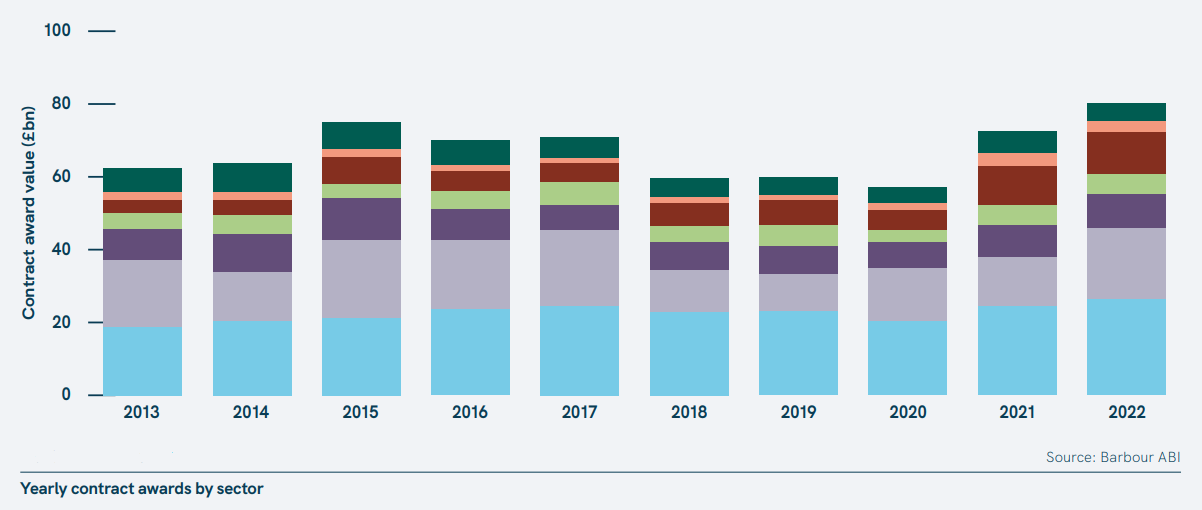

Construction contract awards hit record £80.4bn in 2022

While much commentary has focused on the negative impact of current economic conditions, new data from Barbour ABI points to some areas of positivity for the construction sector.

Record-high contract awards were achieved in both the residential and industrial sectors last year, with the latter more than doubling thanks to higher demand for warehousing post-Brexit.

Partly driven by a post-Covid recovery as projects and investment came back into the sector, the impact of cost volatility played its part too.

Tom Hall, chief economist at Barbour ABI, said: “Whilst record highs may initially seem surprising given current economic conditions, part of the overall increase is doubtless due to input cost increases inflating construction costs. We are also seeing the filling of a weak construction pipeline after pre-Brexit uncertainty and the pandemic.

“The overall increase was also driven by infrastructure spending, rising by £6bn to £19.6bn, focused mainly on renewable power generation. Meanwhile, the commercial sector had an excellent 2022 with £9.4bn in contracts awarded - a 30% increase compared to 2020. However, this was driven by an exceptional Q1, a pattern that did not continue as the Cost-of-Living crisis began to bite later in the year.”

2022 saw the highest-ever annual residential contract awards of £26.3bn, an 8% increase on 2021 and a 30% increase since 2020. This was led by a rebound in London and the Southeast.

However, planning approvals for residential developments are yet to see post-Covid recovery, remaining consistent with 2021 and 2020. Meanwhile, residential sector planning applications have fallen by 8% to £49bn in the face of weakening economic prospects.

“Activity remains more mixed in the earlier planning stages” added Mr Hall. “Tellingly, commercially sensitive sectors remain weak at these earlier stages in line with the wider uncertainties and point to tougher times ahead - particularly in residential, as it faces reduced consumer demand driven by high interest rates and higher building costs. That said, activity is mixed throughout the sector, with infrastructure, warehousing and healthcare all doing well.”

Early-stage turbulence in residential construction is mirrored by commercial construction, where planning approvals fell by 27%, putting it back to 2020 performance. Planning applications fell by 5%, reaching their lowest level since the 2008 financial crisis.