Construction output expands at sharpest pace since September 2014

The recovery in UK construction output gained considerable momentum in March, supported by robust rises in house building, commercial work and civil engineering.

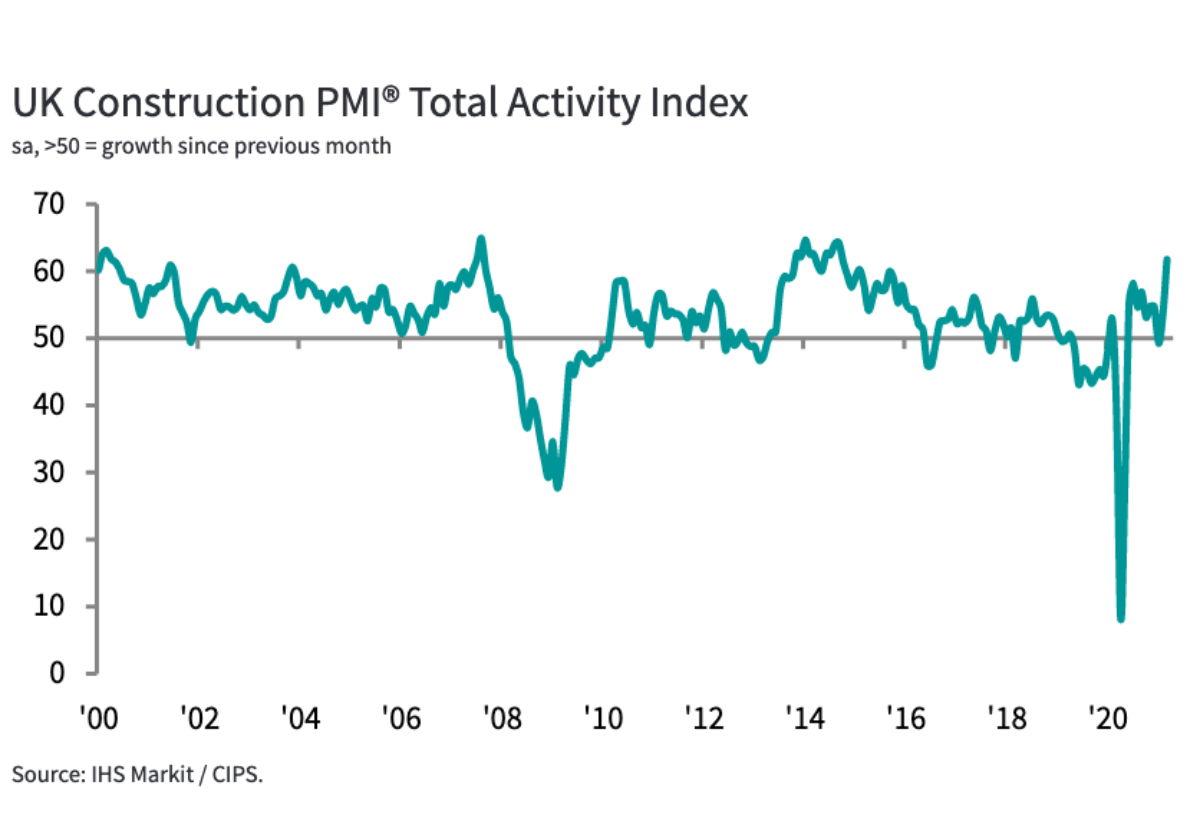

Adjusted for seasonal influences, the IHS Markit/CIPS UK Construction Total Activity Index registered 61.7 in March, up sharply from 53.3 in February. The latest reading signalled the strongest rate of construction output growth since September 2014.

Housebuilding (index at 64.0) was the best-performing category, with growth the fastest since July 2020. Strong increases in activity were also seen in commercial construction (62.7) and civil engineering (58.0) in March, with the index readings for both segments the highest since the second half of 2014.

Survey respondents often commented on the mobilisation of delayed projects, especially in areas such as hospitality, leisure, and office development. There were again reports of a boost from major infrastructure projects in March, as well as higher workloads due to greater spending on residential construction work and rising new home sales.

Improving client demand and contract awards on projects that had been put on hold earlier in the pandemic contributed to a steep upturn in new orders during March. Moreover, the rate of expansion accelerated to its fastest since September 2014.

Forthcoming new project starts spurred a solid rise in employment numbers, with the rate of job creation the strongest for over two years in March. Construction companies also signalled a sharp increase in purchasing volumes in response to greater workloads. The latest upturn in input buying was the steepest since November 2020.

Higher demand for construction products and materials contributed to longer wait times for deliveries by suppliers. Around 41% of the survey panel reported longer delivery times from suppliers in March, while only 1% saw an improvement. Supply constraints and logistics issues were commonly reported by construction companies, especially for imported items.

Imbalanced demand and supply for construction inputs led to the steepest increase in purchasing prices since August 2008. Survey respondents widely noted that suppliers had cited Brexit and COVID-19 as reasons for price hikes in March.

Meanwhile, the latest survey indicated a strong degree of confidence towards the year ahead outlook for construction activity. Growth projections were the most upbeat since June 2015, reflecting confidence in the UK economic outlook, the improving pandemic situation and pent up demand.

Tim Moore, economics director at IHS Markit, which compiles the survey, said: “March data revealed a surge in UK construction output as the recovery broadened out from house building to commercial work and civil engineering. Total activity expanded to the greatest extent for six-and-a-half years as residential spending remained robust, commercial projects restarted and infrastructure contract awards moved ahead.

“Improving confidence among clients in the commercial segment was a key driver of growth, with development activity rebounding in sectors of the economy set to benefit the most from the improving pandemic situation. The increasingly optimistic UK economic outlook has created a halo effect on construction demand and the perceived viability of new projects.

“Constrained supplier capacity and stretched transport availability continued to pose challenges for the construction sector in March. Short supply of products and materials pushed up purchase prices at the fastest rate since August 2008.

“Continued pressures on supply chains are expected in the near-term, but these concerns did little to dampen confidence about the business outlook. The latest survey pointed to the strongest growth projections across the UK construction sector since those reported during a post-election bounce back in June 2015.”

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, which sponsors the survey, added: “Construction was full of the joys of spring in March with a sudden leap into solid growth fuelled by across the board rises in workloads in all sectors. The commercial pipeline was particularly spectacular giving its best performance since late-2014.

“This upturn led to a significant boost in hiring levels with the fastest upturn in job creation since December 2018 offering a clear sign that companies are feeling more positive in planning for new builds and refurbishments of current properties.

“Business confidence was also standing tall with future optimism about the next 12 months the highest since June 2015 which suggests it is mostly plain sailing now that lockdowns are ending and vaccine programmes are underway. The unfortunate spanner in the works comes in the form of the steepest inflationary rise in raw materials and other construction items since August 2008 at the height of the last commodity price cycle. Supply chains are still underperforming and almost half of the survey respondents said they had experienced longer delays and higher costs. If this continues, it could easily cool the sector down a notch.”