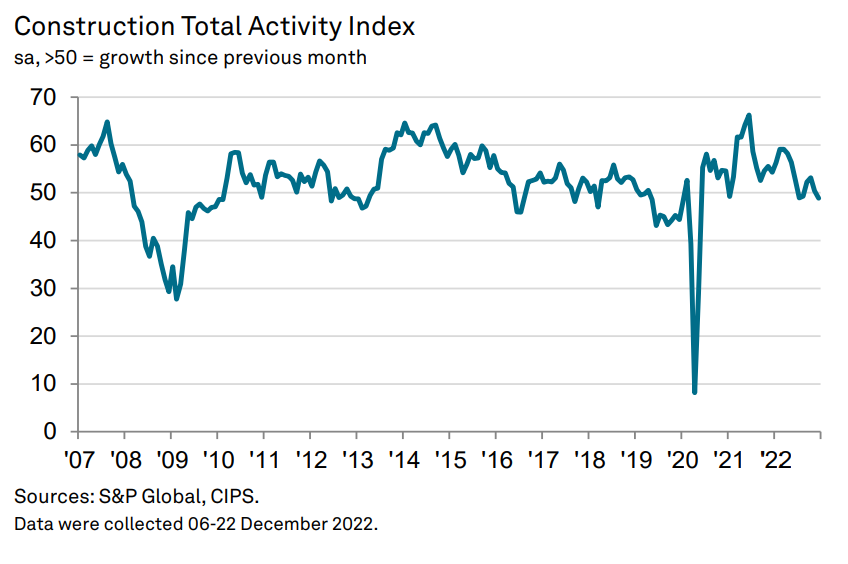

Construction records fastest rate of decline since May 2020

The UK construction sector is now witnessing a contraction in activity that has affected other sectors after it ended a three-month sequence of growth in December.

A similar trend was observed for new orders, which saw a renewed fall that was the strongest for over two-and-a-half years.

Concurrently, sentiment amongst firms towards the year ahead outlook for activity dipped into negative territory for only the sixth time on record, reflecting fears around the near-term economic outlook. Pessimistic expectations were reflected in the first round of job shedding in the construction sector since January 2021.

At 48.8 in December, down from 50.4 in November, the headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – registered below the 50.0 mark to signal the first contraction in construction sector output since last August.

Although commercial construction activity continued to rise in the final month of the year, the rate of contraction eased to the slowest in the current four-month sequence and was

only fractional overall (index at 50.3).

As such, the uplift in the commercial sector was outweighed by contractions across the residential and civil engineering sectors in December. Housing activity declined for the first time since last July and only marginally (48.0), while civil engineering recorded a sixth consecutive monthly contraction in output (46.8) and the rate of decline remained sharp overall.

December data also highlighted a reduction in new orders placed with UK constructors, following a modest uplift in November. According to survey respondents, the fall was driven by weak client demand, linked in turn to higher prices charged. Moreover, the rate of contraction was the fastest since May 2020.

Challenging business conditions were reflected in confidence amongst constructors towards the year-ahead outlook for activity, which dropped into negative territory for the first time since the initial COVID-19 wave and for only the sixth time on record. Downbeat sentiment was attributed to expectations of a recession and poor demand conditions, as well as inflationary pressures. That said, the degree of pessimism was marginal.

December data pointed to the first fall in employment since January 2021. Weak sales meant vacancies were often not being filled, according to panellists. Elsewhere, firms pared back on their purchasing for first time in three months in December, reportedly due to lower workloads. Notably, the rate of reduction was the steepest for over two-and-a-half years.

Average lead times for inputs lengthened to a greater degree nonetheless, with delays the most severe since last June. Shortages and shipping issues were cited as the cause.

Turning to prices, costs faced by construction companies continued to increase during the final month of the year, linked by panellists to energy, material, fuel and import costs.

Although still marked, the rate of inflation was the weakest for two years. Rates charged by subcontractors also rose in December, but at a slightly reduced pace.

Lewis Cooper, economist at S&P Global Market Intelligence, which compiles the survey said: “The UK’s construction sector registered a relatively poor finish to 2022, with business activity falling into decline following a three-month growth sequence amid the fastest contraction in new work since the initial pandemic period in May 2020. Companies cited weak client demand, driven partly by higher prices amid ongoing inflationary pressures.

“Commercial construction activity remained the only bright spot, though here the rate of growth came close to stalling, with the overall contraction led by a further sharp decline in

civil engineering and the first fall in residential construction activity since last July.

“The challenging environment in December was subsequently reflected in pessimism amongst firms towards activity levels over the coming year, with business confidence downbeat for only the sixth time since the survey began in April 1997.

“With the outlook turning negative, staffing levels declined for the first time since the start of 2021 in December. Though panellists primarily attributed the fall to the nonreplacement of leavers, the data show that companies are preparing to face significant challenges in the months ahead.”

Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply, said: “The construction sector was stuck in the mud in December with the steepest fall in activity since the beginning of the pandemic in May 2020 and a similarly fast drop in pipelines of new work.

“House building saw a notable change of direction, with a mix of higher inflation for raw materials and transportation and the squeeze on affordability rates for mortgages resulting in fewer house sales. The sector subsequently fell back into contraction for the first time since July. Civil engineering, responsible for larger projects, continued to be the weakest performer again, with a sixth month in the doldrums as uncertainty about the UK economy reared its ugly head again and customers hesitated. Supply chain managers reined back spending on materials with the sharpest fall in buying activity for over two-and-a-half years as a result of this poor demand.

“Optimism remained very flat and at one of the starkest rates in the survey’s history. Builders were reining back on recruitment unconvinced there will be enough growth in the UK economy in 2023 to justify additional expenditure when margins remained so squeezed. Builders are fast running out of the resilient spirit maintained over the last couple of years as the blocks to success piled up and the winter of discontent with high inflation, strikes and shortages continues.”

Mark Robinson, group chief executive at SCAPE, added: “After a drop off in activity towards the back end of last year, December’s figures are further evidence of the recession strengthening its grip on the economy.

“The construction industry is braced for a tough year and, while there are positive signs that inflation has peaked, increased material costs will undoubtedly continue to shape the plans of developers and local authorities – that latter of which will be confirming their annual budgets this month.

“Maintaining clear, positive dialogue in 2023 will be crucial if projects are to progress uninhibited, and calm and cautious management will likely pay dividends further down the line when purchasing decisions are ready to accelerate again.”