Construction sector growth eases in October

Output growth across the UK’s construction sector slowed considerably during last month after reaching a 29-month high during September, the latest PMI data has indicated.

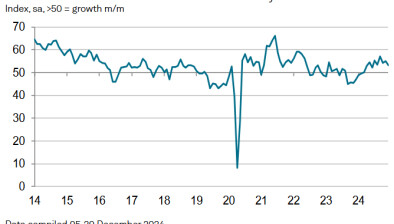

The headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – registered 54.3 in October, down from 57.2 in September. However, the index was above the crucial 50.0 no-change threshold for the eighth month running. The latest reading was also well above the average seen in the first half of 2024 (51.4) and signalled a solid expansion of total industry activity.

Civil engineering (56.2) was by far the best-performing category of construction output in October. Survey respondents again noted rising demand across a range of energy infrastructure projects, especially renewables. Commercial work (52.8) also expanded in October, but the increase was the weakest since the current period of growth began in April.

House building (49.4) was the only broad category of construction work to register an overall decline in output during October. This was the first decrease in residential activity since June, but the rate of contraction was only marginal. Some construction companies noted that elevated borrowing costs and uncertainty ahead of the Autumn Budget had constrained demand.

Total new work expanded at a solid pace in October. Mirroring the trend for output growth, the latest expansion was softer than the two-and-a-half-year high seen in September. Political uncertainty and subdued household demand due to cost-of-living pressures were cited as factors limiting new order growth in October. That said, many construction companies noted strong sales pipelines and tender opportunities linked to generally improving domestic economic conditions.

Higher levels of new business encouraged additional staff recruitment in October. Moreover, the rate of job creation accelerated to a three-month high. Greater demand for staff was recorded in spite of a decline in business optimism regarding growth prospects for the year ahead. The latest data indicated that construction companies were the least confident about their output growth projections since December 2023.

Construction companies continued to boost their purchasing activity in October, which was mainly linked to greater workloads and forthcoming new project starts. However, the

latest increase in purchasing activity was only marginal and the weakest since the current phase of expansion began in May.

Suppliers’ delivery times improved marginally in October. Lead times have now shortened in each of the past three months, which was often linked to rising inventories among suppliers. Some construction firms noted that international shipping disruptions had limited the latest improvement in vendor performance.

Average cost burdens meanwhile increased at a solid pace. The rate of inflation remained stronger than seen on average in the first half of 2024, but moderated since September. Survey respondents typically commented on higher raw material prices. Many firms suggested that an improved balance between supply and demand for construction inputs had led to increased competition between suppliers and helped to limit overall cost pressures.

Tim Moore, economics director at S&P Global Market Intelligence, said: “The construction sector signalled another month of solid output growth in October, despite being unable to match the highs seen in September. Business activity expansion was once again led by civil engineering work. Survey respondents widely commented on strong demand for renewable energy infrastructure projects.

“Commercial construction activity also increased again, albeit at the slowest pace since the current phase of expansion began in April. Improving domestic economic conditions helped to boost demand, but some construction companies reported delayed spending decisions ahead of the Autumn Budget. October data meanwhile indicated a decline in overall residential construction activity for the first time since June. Government policy uncertainty, fragile consumer confidence and elevated borrowing costs were all constraints on demand for house building projects.

“Total new work expanded at a solid pace in October, adding to signs of a robust improvement in order book pipelines across the construction sector in the second half of 2024. As a result, construction companies added to their payroll numbers at an accelerated pace. However, business optimism remained relatively subdued in comparison to the highs in the first half of the year, with output growth expectations now the lowest since December 2023.”

Responding to the figures, Jordan Smith, technical director at Thomas & Adamson, part of Egis Group, said: “The market has felt a slight sense of uncertainty over the last month or so, awaiting the impact of the Labour Government’s first budget, which has resulted in some caution with regards to new activity and a slower rate of growth. While PMI dipped between September and October, it remains well above the average seen in the first half of the year. Infrastructure and commercial activity remain buoyant, but the residential sector saw a decline in housebuilding as a result of the changing economic landscape.

“Lead times seem to be improving, but proactive supply chain management remains key to delivering successful projects, with careful planning around procurement, and material delivery times essential to mitigate project risk. It will be interesting to see how the measures introduced by the Chancellor last week further influence the market. Despite job creation now being at a three-month high, the change in employers’ National Insurance contributions, for instance, could have a knock-on effect for new employment, with small businesses having to navigate these new changes.”

Brian Smith, head of cost management at AECOM, said: “The construction industry has enjoyed a healthy period of output growth since early Spring and October’s increase is another clear indicator of a revived industry believes it is moving to firmer ground.

“As we enter the winter trading period, the sector will be encouraged by the Chancellor’s announcement to invest more than £100bn in critical infrastructure across the public estate – driving long-term growth and economic stability. To achieve this, the private sector will need to play a central role in ensuring these complex programmes get off the ground and deliver the vital services across healthcare, education and transport.

“With demand set to strengthen as 2025 approaches, the outlook is certainly brighter and a much-needed period of economic stability will stimulate a recovery in private sector investment.”

Brendan Sharkey, real estate and construction specialist at UK accountancy firm MHA, said: “Following last month’s spike in activity, it was expected that construction PMI would decrease this month. However, the industry has been steadily growing since April of this year, with PMI remaining above 50, suggesting that the construction industry is on a firm footing.

“This month’s data suggests that activity in the commercial sector remains steady, but housing activity has dipped slightly.

“The Budget will have come as welcome news broadly to the construction industry. It has kickstarted a programme for much-needed affordable housing and infrastructure as Rachel Reeves has highlighted both areas as a priority for the Labour government.

“While there were no fundamental announcements on Labour’s housing strategy, which is now likely to be announced in the Spring, the consultation on the Mortgage Guarantee Scheme with a view to making permanent the support of a 95% loan to value on first time buyer’s purchase would give house builders some confidence in this sector of the market.

“The increase in employers’ National Insurance contributions will have come as a blow to the sector as it has done for all businesses. Initially these will have to be absorbed, but given the modest margins the industry works with, ultimately they will have to be passed on to the customer.

“The biggest new challenge the management of the sector faces is the reduction to 50% for Business Property Relief from April 2026, as many owner-managed construction companies have historically invested heavily in their companies as a substitute to pensions as a tax efficient way of building a value that they can pass on to the next generation. As a result of the announcements last week the need for effective long-term financial planning has become more critical to avoid the enforced disposal of businesses to cover tax liabilities.”