Declining demand and available stock impact new home sales

July recorded the third consecutive month of new buyer enquiries

Demand for residential housing in Scotland continues to ease, but the lack of supply is still driving house prices up, according to the latest Royal Institution of Chartered Surveyors (RICS) Residential Market Survey.

In July, a net balance of respondents reported a decrease in new buyer enquiries; at (-37%), this was the third consecutive month in negative territory.

At the same time, the net balance of respondents (-44%) reported a fall in new instructions to sell, meaning stock on the market is limited. This is a pattern familiar to the Scottish market, with more respondents reported to have seen a decrease than increase in new instructions to sell for the past 12 months.

With limited stock and easing in demand, a net balance of respondents reported a fall in sales (-24%). Supply shortages and less demand have also impacted the sales outlook of the market, with a net balance of respondents expecting sales to fall; at (-9%), this is the lowest this balance has been since January 2021.

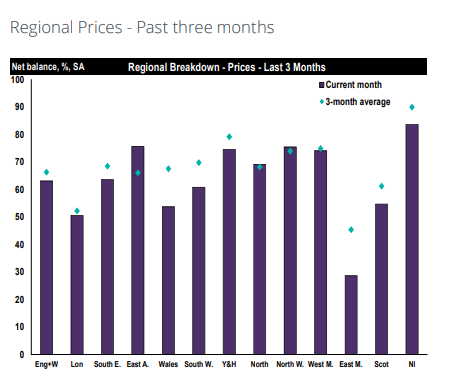

Looking at pricing, a net balance of +55% of respondents reported that prices rose over the past twelve months, however respondents are expecting prices to fall flat over the next quarter.

Ian Morton MRICS, Bradburne & Co in St Andrews, said: “There has been the traditional slow down during the summer holiday period although we are preparing properties for sale after the schools return from holiday.”

Jennifer Campbell MRICS from DM Hall added: “A shortage of sales stock available on the open market continues to drive competitive closing dates with prices offered up to 20% over market value. It is anticipated that the second energy price hike will likely affect affordability and prices will come back down.”

Tarrant Parsons, senior economist for RICS, concluded: “Amid a backdrop of sharply rising living costs, slowing economic growth and higher interest rates, it is little surprise that housing market activity is now losing some momentum. With monetary policy set to be tightened further over the coming months, sales expectations point to a further softening in transaction volumes going forward.

“Nevertheless, with respect to house prices, limited supply available is still seen as a crucial factor underpinning the market. Although house price growth is likely to continue to ease, respondents still anticipate prices will be modestly higher than current levels in a year’s time.”