Deloitte: Edinburgh remains first for regional hotel investment

Edinburgh has retained its position as the most attractive city for UK regional hotel investment for the fourth consecutive year running, and has moved up one spot to ninth most attractive in Europe, according to Deloitte.

Over half (54%) of respondents to Deloitte’s 2024 European Hotel Industry and Investment Survey ranked Edinburgh first. The Big Four firm also named London as the most attractive European city for hotel investment for the second year running.

Deloitte asked nearly 100 senior hospitality leaders, owners, lenders, developers, and investors about the key trends that will shape the hospitality industry in 2025. The survey took place between 7 August and 17 September 2024.

Investors continue to eye up London and Edinburgh

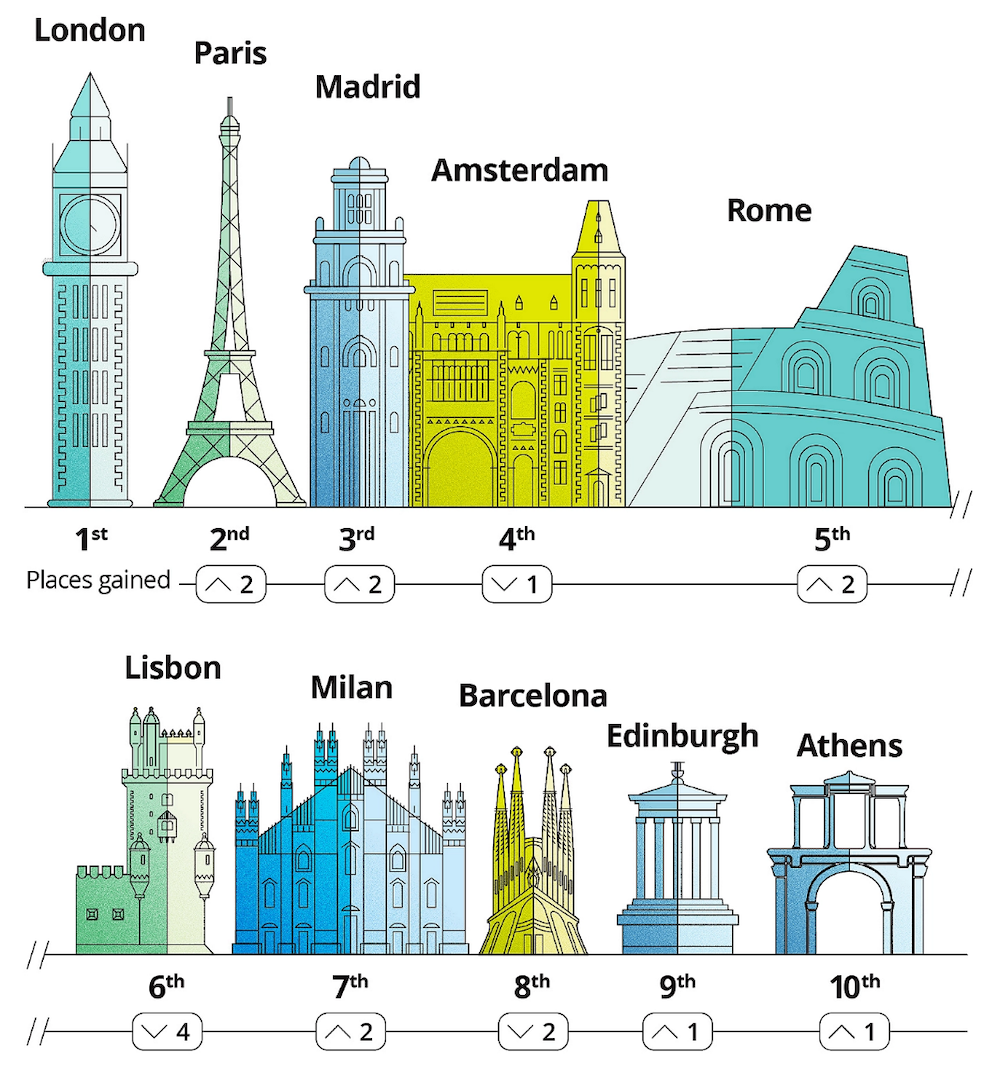

London was followed by Paris and Madrid, which moved up the list to second and third respectively, while Amsterdam fell to fourth place and Porto entered the ranking for the first time in 12th place.

Edinburgh’s top spot for UK regional hotel investment for the fourth consecutive year running was followed by Oxford (25%) in second place and Manchester (22%) in third place, while Birmingham moved three places up the ranking to sit as the fifth most attractive UK city for investment in 2025.

Leila Jiwnani, head of hospitality & leisure advisory at Deloitte, said: “Edinburgh continues to sit steadfast at the top of our UK ranking as an attractive, safe and growth investment opportunity as a popular tourist destination.”

Hospitality industry remains cautiously optimistic

Three out of four (72%) hospitality executives say they are optimistic about the long-term future of the UK hotel market. However, there has been a five percentage-point fall in those expecting the UK hotel sector to materially grow over the next five years (59% in 2024 vs 64% in 2023).

When asked if UK hotels will likely become more profitable over the next five years, sentiment waned by 10 percentage-points (54% in 2024 vs 64% in 2023).

Respondents once again cited rising costs (79%), labour challenges (77%), and interest rates (71%) as the top three key risks threatening growth to the hotel industry. Meanwhile, there is growing concern around the immediate risks of overtourism. Close to one in three executives (28%) recognise overtourism, or local resentment towards tourists, as a risk, recording the biggest jump year-on-year in the survey – up nine places overall.

Most hotel industry executives (88%) expect managing cashflow to be their top priority over the next 12 months. This was closely followed by improving performance, maintaining or increasing profitability, and managing inflationary pressure, each at 86%.

A surge in M&A activity is expected in the year ahead with most executives (70%) anticipating an increased level of competition for hotel acquisitions in 2025, and one in two businesses (54%) saying they plan more acquisitions in the year ahead. For two-thirds of executives (62%), the focus is on strategic partnerships or joint ventures and acquisitions in high-growth markets and key destinations. When asked what the most attractive hotel segment was for investment in 2025, a quarter (24%) said upper upscale, followed by luxury (22%) and economy (17%).

Ms Jiwnani added: “M&A activity is picking up and hotels remain by far the most popular investment class, but we’ve also identified the increasing attractiveness of hostels as an investment asset across Europe in the year ahead too.

“We also expect investors to favour the luxury end of the market in line with the growth in hotels offering premium experiences, but these preferred strategies risk leaving the mid-range hotels out in the cold.

“Coming back from a decline in recent years, private equity as a source of capital for hotel investment has risen 10 percentage-points over this year, demonstrating the increasing appetite for M&A in the sector.

“However, while hoteliers actively manage their portfolios, transform and review their assets, they are cautious about diversifying and may well prefer strategic growth and consolidation in the year ahead.”