Knight Frank: International investors lead Scottish commercial property market post-referendum

Scotland’s commercial property market has attracted significantly more international interest in the decade that followed the 2014 independence referendum than it did in the 10 years prior to the vote, according Knight Frank.

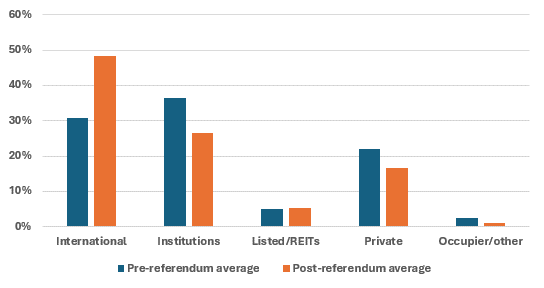

The independent commercial property consultancy’s analysis of Real Capital Analytics (RCA) data found that in the build-up to the 2014 referendum, UK institutional investors accounted for the largest share of investment in Scottish commercial property at 36%.

However, during the 10 years that have followed, international investors averaged nearly half of investment volumes at 48% – rising from 31% between 2004 and 2013, and well ahead of UK institutions’ annual average of 26%.

So far in 2024, in a reversal of the post-referendum trend, international investors have accounted for just 25% of investment volumes, while real estate investment trusts (REITs) and private buyers have represented 31% each.

Scottish commercial property investment by buyer type, pre- and post-referendum (source: RCA, Knight Frank)

Average annual investment volumes have largely remained consistent, at £2.45 billion pre-referendum and £2.48bn in the decade that followed. Both ten-year periods included major events that affected markets, including the global financial crisis, Brexit, and the Covid-19 pandemic.

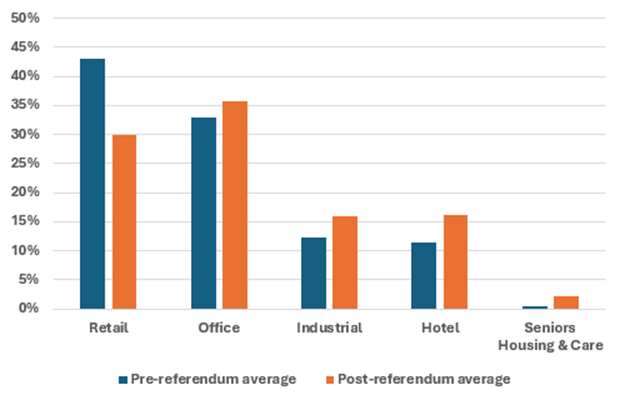

Scottish commercial property investment by asset type, pre- and post-referendum (source: RCA, Knight Frank)

Over the 20 years analysed there have also been a number of changes to Scotland’s economy. Retail’s share of investment volumes has dropped from 43% pre-referendum to 30% in the 10 years afterwards, as the sector faced structural challenges from consumers shifting to e-commerce.

Investment in hotels rose from 11% to 16%, as Scotland grew in popularity as a tourist destination. The number of international tourists rose from 2.3 million in 2013 to 4 million during 2023, according to figures from the Scottish Tourism Observatory.

Alasdair Steele, head of Scotland commercial at Knight Frank, said: “A lot has changed in the ten years since the independence referendum – both directly and indirectly related to the vote being held.

“Understandably, in the immediate build up to and aftermath of the referendum, UK institutions paused investment in Scottish commercial property, because there was some uncertainty over whether those assets would remain within their mandate.

“That created an opportunity for international investors to fill the gap and, with the exception of this year, they have been the largest buyers since 2015.”

Alasdair Steele

He continued: “At the same time, consumer trends have changed a great deal since 2014 and you can see that reflected in the levels of investment in retail property.

“In 2004, the sector accounted for 59% of total investment volumes, which fell to a low of 17% in 2021. But, retail has rebounded from that low and the arrival of St James Quarter in Edinburgh and the recent sale of Union Square in Aberdeen demonstrate there are opportunities emerging in the sector again.

“A stake in St James Quarter that was put up for sale this summer is attracting a good level of interest.

“The marked difference between this year and the trends that emerged post-referendum also show that things are changing all the time. Private purchasers, typically family offices or ultra-high-net-worth individuals buying with cash, have re-emerged as one of the key drivers of deals in the Scottish commercial property market, as debt-financed investors have been subdued by higher interest rates.”

Mr Steele concluded: “Nevertheless, there are a few themes that seem likely to bear out for the foreseeable future.

“Hotels will remain a popular asset class as we welcome more visitors to Scotland, while offices should continue to recover from the effects of the pandemic – the recent sale of The Mint in Edinburgh suggests there are green shoots in the office investment cycle. And student accommodation is emerging as another significant asset class, with a number of developments underway and a chronic lack of supply persisting in many university cities.”