Knight Frank: Scottish commercial property rent disputes dip, but industrial cases remain high

Commercial property rent disputes between landlords and occupiers in Scotland saw a decrease in 2024, despite continued rises in prime rents across major occupier markets, according to new Knight Frank analysis.

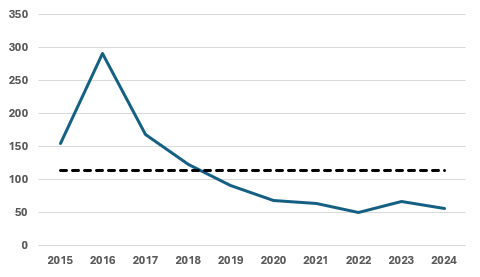

The independent commercial property consultancy obtained figures from the Royal Institution of Chartered Surveyors (RICS) which show there were a total of 57 applications for third-party arbitration in 2024 – down 15% on the 67 recorded during the previous 12 months.

Last year’s figure was the second lowest of the last decade, ahead of only 2022’s 50 cases, after rising for the first time since 2016 the year before. They were also well below the 10-year average of 114 cases.

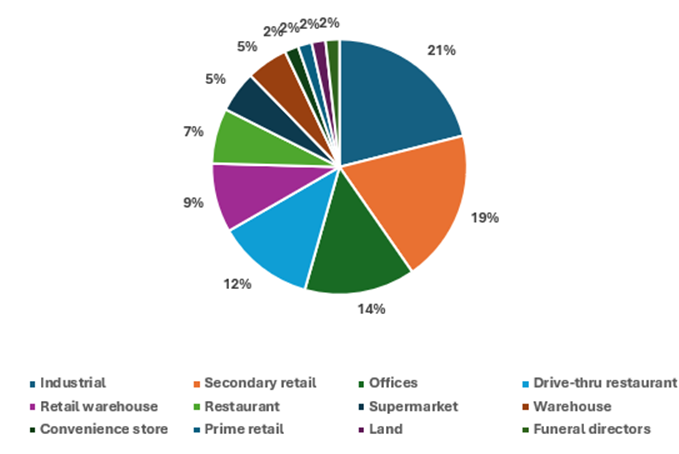

Figure 2: Disputes by sector (Source: RICS, Knight Frank)

The industrial sector saw the highest number of cases, with 12 disputes – 21% of the total – closely followed by 11 in ‘secondary’ retail. Despite prime Edinburgh rents rising at their fastest rate since 2015 during 2023 and increasing again in 2024, offices accounted for just 14% of cases.

Independent experts, or arbitrators, are appointed to cases where commercial tenants and landlords cannot agree on a new rental deal at a fixed-term review date. Typically, these are conducted every five years, depending on the terms of an occupier’s lease.

Andrew Hill – Partner at Knight Frank Scotland

Andrew Hill, lease advisory partner at Knight Frank Scotland, said: “It is slightly surprising to see the number of disputes referred to a third party drop last year, with the occupational markets so buoyant.

“Prime office rents in Edinburgh and Glasgow have risen considerably over the past two years, which typically sets the tone for the wider market, and strong rental performance usually translates into a rise in challenges from occupiers against proposed increases – it may be a sign that the increases of 2023 are easing.

“But, the fact that the industrial sector is the largest source of disputes is a case in point. Rents have been on the rise in that sector for quality space since the Covid-19 pandemic more or less across the board, taking in distribution centres, trade counters, and manufacturing. And, with more new schemes coming on, rents may need to increase again to reflect the cost of development, which has gone up considerably in the last few years.”

Number of commercial property disputes 2015-2024 vs 10-year average (Source: RICS, Knight Frank)

Mr Hill continued: “Retail has been suppressed for a long time – given the changes the industry has been going through, there has been little prospect of rental growth beyond prime areas such as Buchanan Street in Glasgow and George Street in Edinburgh.

“It still has a long way to recovery, but the disputes in secondary retail likely come from areas establishing themselves as strong trading locations – for example, Finnieston or Leith.

“Overall, the main occupational markets in Scotland remain in relatively good shape – Grade A office vacancy rates in the three main cities are at low levels and, as in recent years, occupiers continue prioritise the best quality space.

“Retail has rebased and industrial is still short on supply of high-quality space. In time that could translate into more rent reviews having to go to third parties, even though the number of cases that have gone to arbitration so far this year are relatively low.”