Knight Frank: Scottish commercial property rent disputes rise for first time since 2016

Andrew Hill

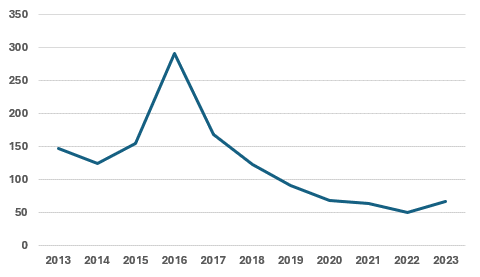

The number of commercial property rent disputes between landlords and occupiers rose for the first time since 2016 as more cases had to be referred to a third party for resolution, according to Knight Frank.

The independent commercial property consultancy obtained figures from the Royal Institution of Chartered Surveyors (RICS) which show there were a total of 67 applications for third-party arbitration in 2023 – up 34% on the 50 recorded during the previous 12 months.

Last year’s figure was the highest since 2020s 69 cases, but is around half the annual average of 123 since 2013. There were 24 in Edinburgh and another 23 in Glasgow, while the remainder were spread across Scotland.

So far in 2024, there have been 16 applications for third-party review, suggesting that the number of cases will remain comparatively low again this year.

Independent experts, or arbitrators, are appointed to cases where commercial tenants and landlords cannot agree on a new rental deal at a fixed-term review date. Typically, these are conducted every five years, depending on the terms of an occupier’s lease.

Rent disputes in Scotland referred to third-party determination 2013-2023 (Source: RICS)

Andrew Hill, lease advisory partner at Knight Frank Scotland, said: “It’s unsurprising to see the number of rent disputes tick up after hitting their lowest point in a decade in 2022.

“During the pandemic, there was greater collaboration between landlords and occupiers, with the former providing rent-free periods and deferring rents in exchange for lease extensions. That was inevitably going to change as conditions normalised and more people came back to the office.

“At the same time, prime rents are seeing considerable rises in Edinburgh and Glasgow. Landlords – mainly of prime, Grade A properties – see it worthwhile pushing for increases at the moment, whereas they may not have in previous years.”

MR Hill continued: “Given the lack of availability of Grade A space in Edinburgh, in particular, there are few options for occupiers to choose from if they were to decide to move within the next year or two.

“However, it’s worth noting that the number of cases going to a third party remains low by the standards of the past decade. Structural changes to sectors such as retail are likely to be a major contributor to the decline in rent disputes – the difficult conversations largely happened as e-commerce began to really take its toll on high street retail in the middle of the 2010s.”

He concluded: “The occupational markets in Scotland are in relatively good shape – Grade A vacancy rates in the three main cities are at very low levels and occupiers are increasingly prioritising the best quality space.

“In time that could translate into more rent reviews having to go to third parties, even though the number of cases that have gone to arbitration so far this year are relatively low.”