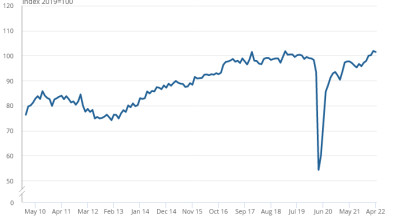

ONS: Construction output declines as sector deals with Brexit uncertainty

The impact of continued uncertainty over Brexit, rising costs and squeezed margins are all reflected in the latest construction output figures from the Office for National Statistics (ONS), Scottish contractors have said.

According to today’s report, the all work series decreased by 0.3% in Quarter 4 (Oct to Dec) 2018, following an increase of 2.1% in Quarter 3 (July to Sept) 2018. This decrease was driven by repair and maintenance output, which was down by 2.8%.

Allan Callaghan

The decrease in repair and maintenance was caused by drops in private housing and non-housing repair and maintenance output of 4.0% and 2.9% respectively.

These falls were offset somewhat by a 1.1% increase in all new work, driven by increases of 1.9% in infrastructure and 1.4% in private commercial new work.

The monthly series saw a sharper decline, with the all work series in December 2018 decreasing by 2.8% below the level seen in November 2018; this is the largest month-on-month fall in growth for all work since June 2012, when the series dropped by 4.3%.

When compared with 2017, the level of all work in 2018 saw a 0.7% increase; this was the lowest annual growth since 2012, which saw a 6.9% decrease in annual output.

Allan Callaghan, managing director of Cruden Building, said: “The construction industry has not been without its challenges in recent months, as uncertainty over Brexit, rising costs and squeezed margins have all had an impact. This is reflected in this month’s report which shows a decline in construction output.

“However, in contrast to this, across Cruden Group, we have secured a healthy order book for the year ahead and expect to build in excess of 1,500 homes this year alone.

“There remains an urgent need to plug Scotland’s housing shortfall and provide more quality affordable homes yet this is being severely constrained by the length of time it takes for both private and social housing developments to go through the planning process. This needs to be immediately addressed so that proposed developments are agreed quicker and more effectively, in order to provide the modern, quality homes that Scottish families so badly need and to safeguard the future health of this important sector.”

Gordon Reid

Kier Construction Scotland’s regional business development manager, Gordon Reid, said: “While the overall picture for construction output shows a drop in activity, the recent trading update for Kier Group shows that we are bucking the trend by expanding our order book and providing diverse employment and training opportunities throughout Scotland.

“Within Kier Construction Scotland, we have recently secured over £100m of new contracts over the last few months alone and are currently on site, building the state-of-the-art £30m Alness Academy for The Highland Council through the hub North Scotland procurement vehicle and carrying out the £66m redevelopment of the Burrell Museum in Glasgow’s Pollok Park.

“While these exciting projects bring the chance to attract new talent, we can’t forget that the sector is in the midst of a skills shortage. Kier has successfully launched a campaign called Shaping Your World with 1% of our workforce engaging with schools and colleges to highlight the vast career opportunities in the construction industry. Over the last year alone, we have invested 500 hours engaging with nearly 6,000 Scottish school pupils highlighting the breadth of career opportunities in construction and the significant boost that this sector delivers to the economy.”

Commenting on the figures, Clive Docwra, managing director of construction consulting and design agency McBains, said: “Today’s figures show a mixed picture – unsurprising given concerns about the UK economy and whether it can withstand a no-deal Brexit. These fears, coupled with longer running issues such as high import costs and skilled worker deficits, are now cutting through and impacting key investment decisions.

“To turn the corner, the industry needs confidence and the support of the government. The Brexit uncertainty will need clarifying soon if the sector is to push on and build the homes our country needs.”

Blane Perrotton, managing director of the national property consultancy and surveyors Naismiths, added: “Few sectors have seen the economic brakes slammed on as hard as construction.

“Builders’ booming third quarter – in which output rocketed by 2.1% – feels a lifetime away.

“While the final quarter of 2018 can be filed under ‘slowdown’ rather than ‘slide’ – just – such distinctions are moot in an industry which has been stripped of confidence and momentum.

“The prime suspect in construction’s reversal of fortune is its previously gravity-defying housebuilding sector. A 6.8% drop in new work consigned residential construction to also-ran status, with what little growth there was coming from commercial and infrastructure work.

“Against this grim backdrop, confidence is ebbing away. Last week’s PMI data showed sentiment has plunged back towards the deep-frozen lows of last March, and official insolvency figures confirm nearly 3,000 construction firms went to the wall in 2018; the highest failure rate of any business sector.

“Labour shortages and rising material costs are eating into margins, and intense competition for the little work that is being put out to tender is forcing contractors to bid painfully low.

“Among developers, the sense that a messy ‘no deal’ Brexit is now a very real danger has choked off demand, and where investment can be deferred, it is.

“Barring an improbable, miraculous resolution to Britain’s Brexit deadlock in coming weeks, this painful inertia is set to continue.”