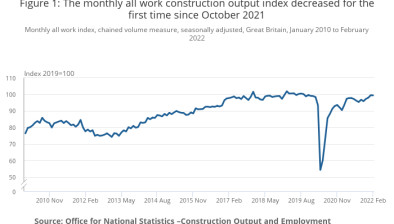

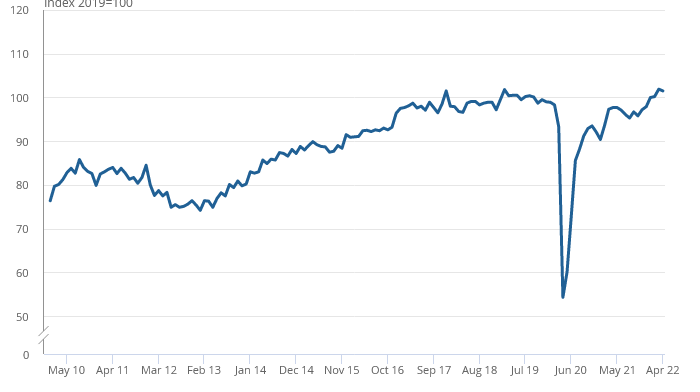

ONS: Construction output sees first monthly decline since October

Source: Office for National Statistics - Construction Output and Employment

Monthly construction output decreased by 0.4% in volume terms in April 2022, marking the first monthly decline seen since October 2021, amid fears about a slowdown in the wider economy.

Figures out today from the Office for National Statistics (ONS) revealed that the decrease came from a fall in repair and maintenance (2.4%), which was offset slightly by a rise in new work (0.9%). The fall is partly a by-product of the growth (3.0%) in March 2022, because of the demand caused by the repair work experienced from storms Dudley, Eunice and Franklin in February 2022.

At the sector level, the main contributors to the decline in April 2022 were private housing repair and maintenance, and private commercial new work, which decreased by 6.5% and 3.8%, respectively.

Despite the monthly fall, the level of construction output in April 2022 was 3.3% (£481 million) above the February 2020 pre-coronavirus (COVID-19) level; new work was 0.7% (£68m) below, while repair and maintenance work was 11.0% (£549m) above.

The recovery to date, since the falls at the start of the coronavirus pandemic, is mixed at a sector level, with infrastructure 35.6% (£669m) above and private commercial 27.2% (£676m) below their respective February 2020 levels in April 2022.

Despite the monthly decrease, construction output increased 2.9% in the three months to April 2022; this is the sixth consecutive growth in the three-month on three-month series, with increases seen in both new work and repair and maintenance (2.2% and 4.0%, respectively).

Clive Docwra, managing director of property and construction consultancy McBains, said: “After a strong increase in output in March, today’s figures serve as a reminder that recovery in the construction sector is still subject to dips.

“Work as a result from the storms earlier this year had propped up growth in February and March and masked that the industry is still struggling in the face of continuing pressures including rising inflation, the high cost of building materials and uncertainty as a consequence of the war in Ukraine.

“It means the recovery is based on fragile foundations. Private commercial new work, for example, decreased by 3.8% in April and confidence among some developers remains low with the likelihood of further interest rate rises leading to a pause on some significant investments.”

Gareth Belsham, director of the national property consultancy and surveyors Naismiths, added: “Economic gravity and weakening business confidence have finally caught up with the construction industry.

“As the momentum of 2021 drains away, the slowdown has turned into a slide – with the sector posting its first monthly fall in output for seven months.

“But so far this is a cooling rather than a collapse. Private sector housebuilding continued to expand in April, climbing 1.1% compared to March and 6.5% compared to April 2021.

“There was a big jump in industrial sector construction too, up 7.6% on the month and a dizzying 48.7% on last April.

“On a quarterly basis, the picture is still positive. In the three months to the end of April, output grew by a respectable 2.9%, down from the 3.8% posted in the first quarter of the year.

“But no one should be complacent. The pipeline of new work is starting to slow, with new orders falling by 2.6% in the first three months of the year compared to the final quarter of 2021.

“Once strong investment cases are being tested by soaring construction costs and nagging questions about what demand for the completed project will be like, and as a result increasing numbers of developers are pausing for thought before committing.

“While many construction firms still have reassuringly full order books for the coming months, the future beyond that is looking rapidly less rosy.”