ONS reports marginal increase in construction output

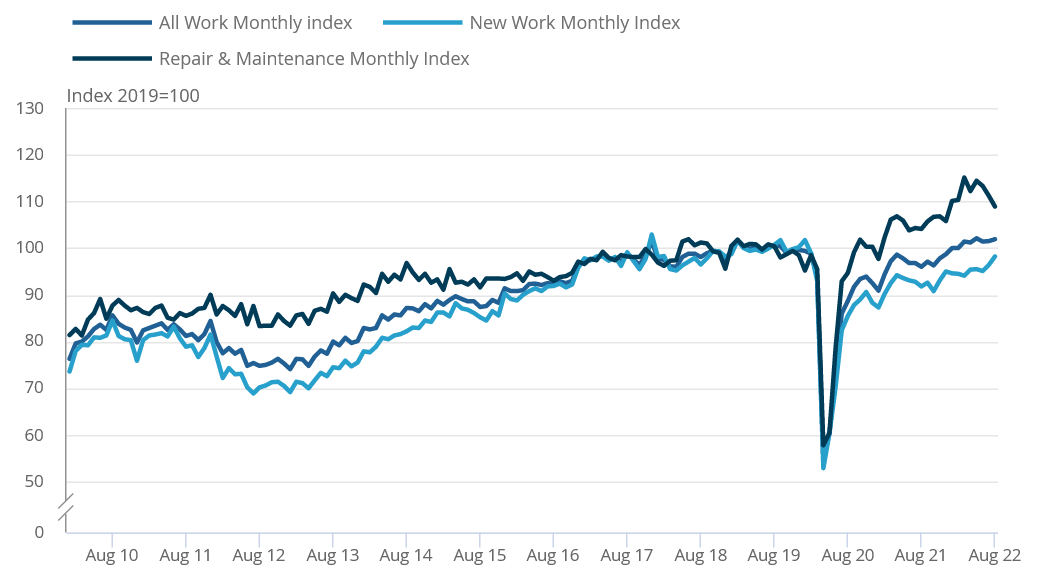

The monthly all work index from January 2010 to August 2022

Monthly construction output in the UK construction sector increased by 0.4% in volume terms in August 2022, which is the second consecutive monthly growth following the upwardly revised increase to 0.1% in July 2022, the Office for National Statistics (ONS) revealed today.

The results mean August 2022 is the second highest monthly value in level terms (£15,011 million), with May 2022 remaining at the highest level since records began in January 2010 (£15,035m).

The increase in monthly construction output came solely from an increase in new work (1.9%), as repair and maintenance saw a decrease (2.0%) on the month. At the sector level, the main contributors to the increase seen in August 2022 were infrastructure, private industrial and private housing new work, which increased 5.3%, 4.3% and 1.7%, respectively.

The level of construction output in August 2022 was 3.2% (£461m) above the February 2020 pre-coronavirus level; new work was 0.7% (£69m) below its February 2020 level, while repair and maintenance work was 10.6% (£530m) above the February 2020 level.

Alongside the monthly increase, construction output saw a slight increase of 0.1% in the three months to August 2022; this came solely from an increase seen in new work (1.6%) as repair and maintenance saw a decrease (2.4%), this is the tenth consecutive period of growth in the three-month on three-month series, however, it is the slowest rate of growth since the three months to October 2021 that saw a fall of 0.7%.

The Federation of Master Builders (FMB) said the 2% fall in repair, maintenance and improvement work in the building industry reflects reduced consumer spend as a result of the higher cost of living.

Brian Berry, chief executive of the FMB, said: “Today’s figures showing a 2% drop in repair maintenance and improvement (RMI) work highlight the real term effects of a contracting economy. This is the third consecutive monthly decline in RMI work, which is the backbone of the construction industry and is often an early indicator of what’s to come for the wider sector. Small local builders are under increasing pressure to keep their bottom lines in the black, as cash strapped consumers hold back on new projects ahead of a difficult winter period.

“The government needs to set out the detail of their pro-growth agenda to help restore confidence in the economy. A win-win would be a nationwide energy efficiency plan to make our homes more energy efficient, which boosts jobs and lowers bills. A more immediate shot in the arm would be a reduction in VAT on RMI work, helping builders pass on savings to customers.”

Clive Docwra, managing director of property and construction consultancy McBains, said: “The moderate growth witnessed in August shows the construction industry is holding firm during a difficult period.

“It’s encouraging that the rise in output is being driven by new work, and the fact that infrastructure, private industrial and private housing new work increased by 5.3%, 4.3% and 1.7%, respectively will be a tonic to the industry.

“However, there are still bumps in the road to be negotiated. Material price inflation may be starting to fall, according to recent figures and from what our clients are telling us, but the cost of construction remains high and further volatility over the medium term can be expected as factors such as Russia’s invasion of Ukraine and the energy crisis bites harder.

“And despite the increase seen in private investment, the risk of recession and high interest rates means some investors are still holding the pause button until the economic picture becomes much clearer.”

Mark Robinson, group chief executive at SCAPE, added: “The construction industry continues to defy wider market conditions to contribute to what is now a near year-long run of growth in the sector.

“As we come out of peak season however, it’s clear that we are set for a challenging winter as inflation continues to affect costs for private and public sector projects alike. The Chancellor’s welcome energy support package will no doubt help, but project teams will need to work in close collaboration to manage costs as projects and pricing evolve.

“Continued investment in public sector building projects will be vital for the well-being of the construction industry – and the country – as a whole this winter, with our figures showing that the sector delivered more than £1bn of social value last year alone.”

Toby Banfield, restructuring partner at PwC UK, said: “The modest growth in new work construction volumes is positive, however, as reflected in the construction PMI results last week, there is still continued uncertainty in the sector, especially outside of infrastructure projects. Increasing debt pricing is likely to make the project economics of new developments more challenging which may impact future new volumes.”

“Construction contracts are typically cash positive from a working capital perspective, which means customers pay up front for various phases of work before the construction starts. A drop in new project volumes reduces cash coming into the business, which leads to cash flow challenges - a move that is increasing pressure with previous cash receipts already used to meet unexpected material price increases on existing projects.

“Getting costs under control, doing proper bottom up forecasts and locking in as many variable costs as possible, with hedging or inflation options will all be critical for managing cash flow going forwards. The manner in which firms react could make all the difference over the next few months.”