Stewart Macleod: Economic impacts of Scottish construction

Stewart Macleod

Faithful+Gould director Stewart Macleod shares this article developed from a paper he and a colleague wrote looking at construction sector conditions.

We wrote previously about the impact of 2020 on the UK construction sector and our work forecasting ahead. We are still facing challenges in the coming years, but there are strong signs of optimism.

So how has this played out in Scotland? Where do we see things going in the next few years?

Our Faithful+Gould team have spent some time getting insights and data to help us form a clear picture.

The legacy of 2020

There is no doubting that the construction sector in Scotland has been impacted by both global and UK events. The pandemic and our stringent lockdown in Scotland saw the sector contract by 41.5% in the 2nd Quarter of 2020. That was deeper than the rest of the UK (32.7% in the same period) and reflects that almost all construction sites were closed in Scotland.

Yet Scottish construction has also seen the same bounce in activity following that sharp contraction. During Q3 2020 the Scottish construction sector output grew by 52% compared to the previous quarter.

Ongoing uncertainty

This sharp decline and positive rise in productivity mirrors the UK and the risks of Covid-19, ongoing lockdowns and Brexit, are the same for both the UK and Scotland. In addition, 2021 will see elections for the Scottish Parliament and undoubtedly discussion regarding a further independence referendum (“Indyref2”).

Sustained growth and recovery for construction will be dependent on a consistent pipeline of work and opportunity. We do therefore worry that uncertainty on a number of fronts may impact decision making and investment plans of both private and public sector organisations.

Forecast Construction Output in Scotland

However, right now there are some positive indications of a strong period ahead for construction. Forecast data published by Experian suggests that outputs in construction will grow by over 10% in 2021 and begin to ‘normalise’ in the following years.

Added to this, we have seen the publication of the Infrastructure Investment Plan and Capital Spending Review, setting out a £33bn investment in Scotland’s future. Government backed pipelines of work bring a massive boost of confidence for the sector.

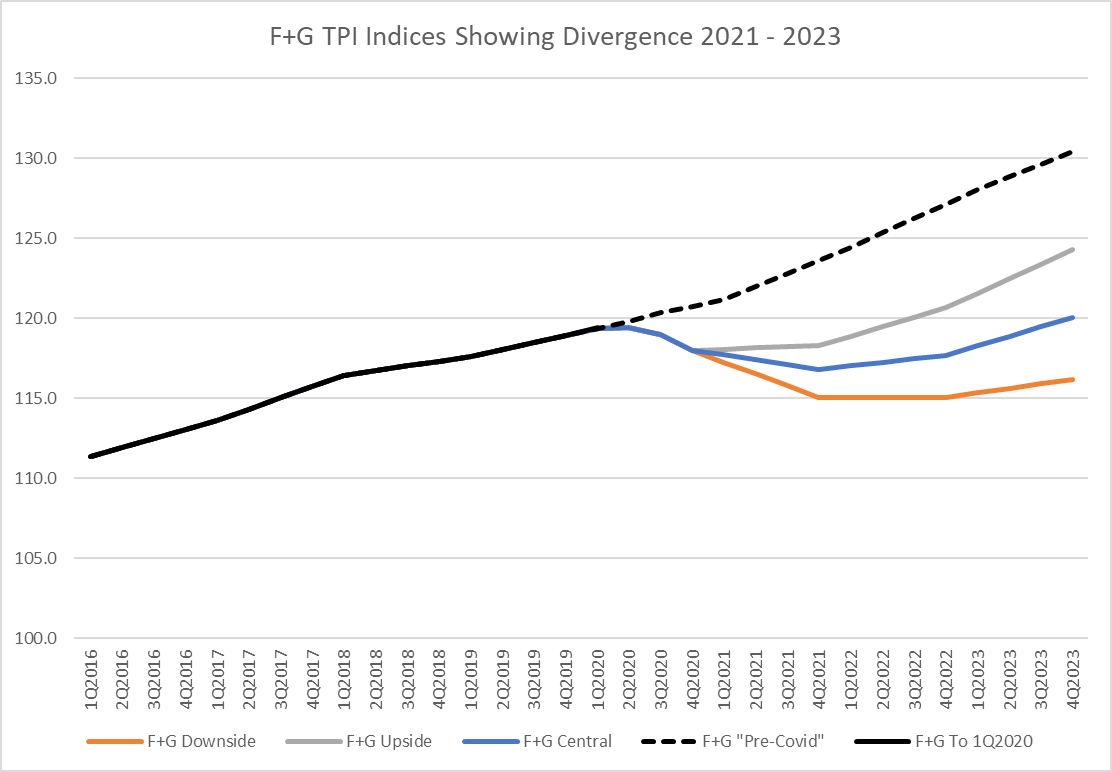

All things considered, our Faithful+Gould team are forecasting the same TPI (Tender Price Indices) for the Scottish market as we have done for the UK:

What is the current state of construction in Scotland?

Yes, the sector may be forecast to (relatively) quickly return to pre-2020 output levels, but short and medium-term investment decisions must consider the conditions now:

Workload/Capacity:

Contractors are reporting that they have secured as much as 90% of their 2021 order book. This is in line or ahead of pre-pandemic metrics for this point in the year and leads to confidence that budgets will be delivered, perhaps even beaten.

Focus is turning to infrastructure projects, which are seen as being ‘government backed’ and therefore certain to progress. Whilst other public sector projects are highly desirable, there are underlying concerns about organisations coming under spending pressures.

Supply Chain

The supply chain in Scotland is extremely busy and described as ‘running hot’. In recent years we have seen a drop in the number of major sub-contractors, resulting in several challenges:

- Obtaining prices.

- The ability to ‘hold prices’ for any reasonable period.

- Local supply chains saturated by large programmes of work.

- Lack of interest in projects which are complex, hold risk or are geographically undesirable.

The supply chain also bore much of the cost of lockdown in 2020. We must wonder whether that absorbed the resilience in the industry. Ensuring cashflow is maintained with diligent payment regimes is critical right now.

Labour

The skills and labour shortage that exists in UK construction is also being experienced in Scotland. It has been for years. The availability of skilled professionals and tradespeople often impacts design, material selection, quality and programming of works.

The good news is the industry in Scotland is not anticipating a significant resource impact as a result of Brexit. Whilst it will undoubtedly have an effect, the Scottish construction sector is not as reliant on EU labour as the rest of the UK.

Materials and Manufacturing Capacity

In many regards there is an optimism around materials and manufacturing capacity that did not exist in 2020. The fact that there is a Brexit trade agreement has provided confidence in the ability to secure materials and products. However, we must remain vigilant:

- Hedged Materials & Manufacturing: major contractors have hedged materials with many of the major suppliers, both in the UK and in the EU. Whilst this is a positive action, it impacts material availability further down the supply chain.

- Component Availability: much focus over the past year has been on large product availability, yet component parts which are key to their production are also a major risk.

- Logistics: securing supply is one part of procurement, with the management of logistics to ensure they reach the construction site being another. Recent events in UK and European ports have highlighted the risks of delays, and the global pandemic has left much of the world’s distribution network out of place, resulting in increased transportation cost and time.

- Pricing Qualifications: suppliers are qualifying their prices for both Brexit and Covid-19 risks. They will narrow or remove those qualifications at the point of contract, but during a tender period they are not able to do so.

Competitiveness

In the industry right now, there is a clear need to be competitive to win work. Yet the demise of Carilion and CBC, is fresh on the minds of many industry leaders. Extreme actions such as nil or even negative margins, are recognised for the ill-advised, short-term measures that they are.

Even consultants are cutting costs as tight as possible. Yet the majority are thinking to the future and recognising that the drive for quality in the industry does not align with radical cost cutting.

However, we are seeing ‘rogue’ prices. Tenders which appear to be lower than the cost of delivery. Clients must be wary of this – for the adage that ‘you get what you pay for’ is very true.

Procurement

Described as ‘the Achilles heel of the industry’. The process of procurement, for designers and contractors alike, is the opportunity to set any project off in the right direction.

Our industry knows this, and we speak about value for money as if it is our guiding light. Yet, despite the current challenges in the market and the universal drive for improved quality, our industry far too often determines ‘best value’ as being the ‘lowest price’.

A race to the bottom helps no one and the industry would benefit massively from a collective approach from client organisations. Let’s learn from lessons in reviews such as the Cole Report and implement joined-up thinking that delivers a true balance between the project goals, the outcomes that will be delivered and the cost to get there.

What does this mean?

We can progress into 2021 with an outlook of cautious optimism. Our industry is resilient, and we have worked our way through many of the challenges of 2020. We also have programmes of infrastructure and public sector works which provide much needed confidence.

The pre-2020 problems remain though: procurement, race to the bottom pricing, quality in design and construction, skilled labour shortages. To name a few. We will get back to where we were, but to go beyond that point there are some aspects of our industry which we must improve upon.