UK Budget: Construction reacts to lack of long-term infrastructure plan

Chancellor Jeremy Hunt MP yesterday outlined the UK Government’s plans to tackle climate change and support its 2030 net-zero targets with a commitment of more than £1 billion to renewable technologies in the next auction round for Allocation Round 6 (AR6) of its Contracts for Difference (CfD) scheme, which will take place later this year.

Also announced during the UK Government’s Spring Budget was confirmation that £390 million will be allocated to offshore wind supply chain and electricity networks as part of the Green Industries Growth Accelerator (GIGA).

Claire Mack, chief executive of Scottish Renewables, welcomed the announcement but added: “The funding allocated to offshore wind is not fully aligned with the increase in deployment required to meet the UK Government’s stated ambition of deploying 50GW of offshore wind by 2030. With a world leading pipeline of projects, we will only achieve this target through deployment in Scottish waters.

“Industry was seeking a budget and framework that would repair the damage to the UK pipeline from last year’s empty offshore auction. We continue to urge ministers to work with industry in the months ahead to ensure this is delivered so that the AR6 budget matches the enormous economic potential of all renewable energy technologies.

“Meanwhile, we are pleased the UK Government has committed to invest around £400m in the offshore wind supply chain and electricity networks through GIGA and look forward to working closely with the government to determine how this funding can be best utilised in the years ahead.”

Homes for Scotland said the Scottish Government must use the £300 million of Barnett Consequential funding allocated for Scotland to restore the housing budget.

Housing saw a cut of over £200 million in December’s Scottish Budget, with organisations from across the sector warning that the cut will put the Scottish Government’s affordable housing programme at serious risk.

Alongside the cut to the Housing and Building Standards Budget, the Scottish Budget saw 26% and 43% reductions in the Affordable Housing Supply Programme and Planning Budget.

Appearing before the Finance and Public Administration Committee at Holyrood in January, deputy first minister Shona Robison assured MSPs that any increase in capital funding as a result of the UK Government’s Spring Budget would benefit housing in Scotland.

Following chancellor Jeremy Hunt’s announcement of around £300m in additional funding to Scotland through the Barnett formula yesterday, HFS chief executive Jane Wood said: “Whilst we await further clarity on how the newly announced funding will be utilised by the Scottish Government, we are calling on the deputy first minister to honour her commitment that any extra money made available to Holyrood will be prioritised for the Affordable Housing Supply Programme and in doing so, help mitigate the prolonged housing inequality experienced currently in Scotland.

“With multiple local authorities having already declared housing emergencies, and our recent independent research finding that over a quarter of Scottish households find themselves in one or more forms of housing need, housing should rightly be prioritised by the Scottish Government to ensure the wide-ranging socio-economic benefits that increased housing delivery across all tenures can be realised.”

The Federation of Master Builders (FMB) said the Budget was a missed opportunity to build new homes and to make existing homes more energy efficient.

Brian Berry, chief executive of the FMB, said: “The Budget could have been an opportunity to kickstart the housing market with house building rates stagnant, but the chancellor has done nothing. It was also disappointing there were no new measures to help homeowners improve the energy efficiency of their homes. This was an opportunity to reform the planning system, boost local authority planning teams’ capacities, and review the financial burdens the planning system places on smaller house builders, but again these much-needed reforms have been overlooked.

“The chancellor could have helped to close the construction skills gap ensuring the UK has the workers with the green skills needed to retrofit the UK’s homes, and provided support to help small builders deal with the administrative burden of training apprentices. All these areas could have grown the economy, instead builders got left behind – this Budget was a missed opportunity.

“The chancellor’s announcement to increase the VAT threshold for small businesses from £85,000 to £90,000 is welcome but the rate has been frozen for seven years so in real terms it makes little difference.”

Gillian Charlesworth, CEO of the Building Research Establishment (BRE), added: “While there was some good news for individuals, with cuts to National Insurance and reforms to child benefit, this was not the net zero Budget the country needed. The UK urgently requires a clear, long-term plan to decarbonise our homes and buildings, and there is still a long way to go to drive the much-needed transition to clean heat. This plan needs to involve a raft of measures, from shifting levies from gas to electricity to encourage householders to install heat pumps, to providing guidance for local authorities so they can deliver retrofit programmes in each area of the country.

“Maintaining funding for our net zero commitments – including those related to the built environment – is crucial if we are to achieve our climate goals by 2050. It is disappointing to see that this detail was lacking from the chancellor’s statement.”

The National Federation of Builders (NFB) said that while the 2023 Autumn Statement saw the chancellor stray into enabling growth through policy strategy and support, the Spring Budget 2024 was more traditional, with the ambition of growth coming through taxation, rather than business enablement.

Richard Beresford, chief executive of the NFB, said: “The Spring Budget offers opportunities to offset costs, invest in innovations and see paths to growth but apart from a strong hand played on energy, it doesn’t enable growth in practice. With the lack of firm planning and procurement reforms, and retrofit entirely left out, there is disquiet that the major growth opportunities will never be realised by this government.”

Within the full budget release, the chancellor identified that 2024 was the ‘year of the SME’ and while reduced taxation, investment allowance and investment opportunity will be welcomed, the dire state of planning policy, lack of supply ambition and numerous new taxes will, and is already seeing, SME housebuilders and regional contractors exit the sector or go out of business.

Rico Wojtulewicz, head of housing and market insight at the NFB, said: “It’s hard to not welcome long overdue grid strategies and some announcements such as digitising and integrating AI into planning, bringing forward nutrient neutrality investment, and enabling more social housing are hugely welcomed.

“However, it’s all a little too late. Planning digitisation has been a key plank of our lobbying for almost a decade. Nutrient neutrality investment is the Government’s response to dropping solutions that they proposed. In addition, the increase in social and affordable housing funding feels like a stats fudge because the Chancellor realises Michael Gove’s policies are decimating the supply of market housing.”

Brian Jones, president of the Construction Plant-hire Association (CPA), said: “The announcement that the government will publish draft legislation to extend Full Expensing to assets for leasing when fiscal conditions allow, is a positive step. However, it is vital we know what these fiscal conditions are and when they will be met.

“We urgently need a timetable of action for this legislation that sets out when CPA members can invest with confidence in new equipment and boost business investment and productivity. The announcement to freeze fuel duty will be welcomed. With oil prices volatile, and the wider economic outlook still uncertain, this is a positive move.”

Infrastructure consultancy firm AECOM criticised the government’s lack of an investment plan to boost the country through infrastructure.

Colin Wood, chief executive of AECOM Europe, UK/Ireland & India, said: “For many years, we’ve heard from the Government about building back better, investing in infrastructure and connecting Britain. In the context of the very difficult past five years, these messages have always been welcome. However, with a General Election looming, there remain fundamental challenges which infrastructure investment could help solve.

“We need to level up the country, build a workable regional and national transport system, and speed up decarbonisation and the energy transition, all through policy centred on the needs of communities and the opportunities better infrastructure brings. This budget won’t, in itself, significantly shift the dial on these big-ticket issues.

“The construction sector is ready to help Britain thrive. As an industry, we need the government to give us direction around the recently published multi-billion pound National Infrastructure and Construction Pipeline (NCIP) so we can build the skills base, invest in innovation and partner with the public sector to deliver. It’s time to restore faith in the UK’s ability to deliver major infrastructure.”

Cameron Stott, head of Scotland at JLL, said: “With interest rates and inflation both remaining sticky, the Spring Budget was never likely to be too transformative for Scottish business. However, whichever party is in power after the next election, they should make sure that supercharging the country’s development pipeline is at the top of their agenda.

“The UK and Scottish governments need to make investment and development in the country a much more attractive proposition. With challenges created by planning, local tax and rent caps, development is grounding to a halt whilst activity in England is starting to pick up.

“Edinburgh and Glasgow are both suffering from a housing crisis and a shortage of super prime commercial space whilst demand remains resilient. According to JLL research, the cost of housing in both cities is more than double the rate in some of England’s regional cities. What we need is policy that makes development more attractive to address this lack of supply to help drive the economy and create jobs.”

Graham Harle, the CEO of Gleeds Worldwide, added: “As chancellor Jeremy Hunt resumed his seat after the Budget, the false bonhomie masking apprehension on colleagues’ faces spoke volumes. With an election around the corner, if it was supposed to buy the government another term of office, I would imagine many Tory MPs will be ordering the removal van.

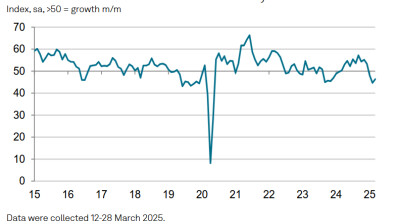

“Construction and property are a bell weather industrial sector as well as big employers and our numbers make for grim reading, with construction activity recording almost flat output levels in February after five months of falls. This is the core issue that the chancellor should have been addressing - how to inspire confidence, fan growth and improve productivity.

“Rather than tinker around the edges doing things like increasing the VAT registration threshold by a meagre £5K, minimal investment in housing and full lease expensing ‘when affordable’, the chancellor should look at the anaemic UK economy as needing a transfusion, not a sticking plaster. GDP is only predicted to be marginally higher this year at 0.8%, for instance. This was a budget to stop us bleeding out before the election, not a long-term recovery plan.”